New research released this week from Data for Progress reveals that a bipartisan majority of American voters know about energy efficiency (68 percent) and that it can reduce energy consumption at home and lower household costs. Additionally, U.S. Energy Information Administration data shows that U.S. energy consumption per household declined by 32 percent between 1980 and 2015 even with rising electrification and appliance use. Yet, despite the broad awareness of and appreciation for energy efficiency, most voters are unaware of top actions and incentives for efficiency improvements.

What tax credit?

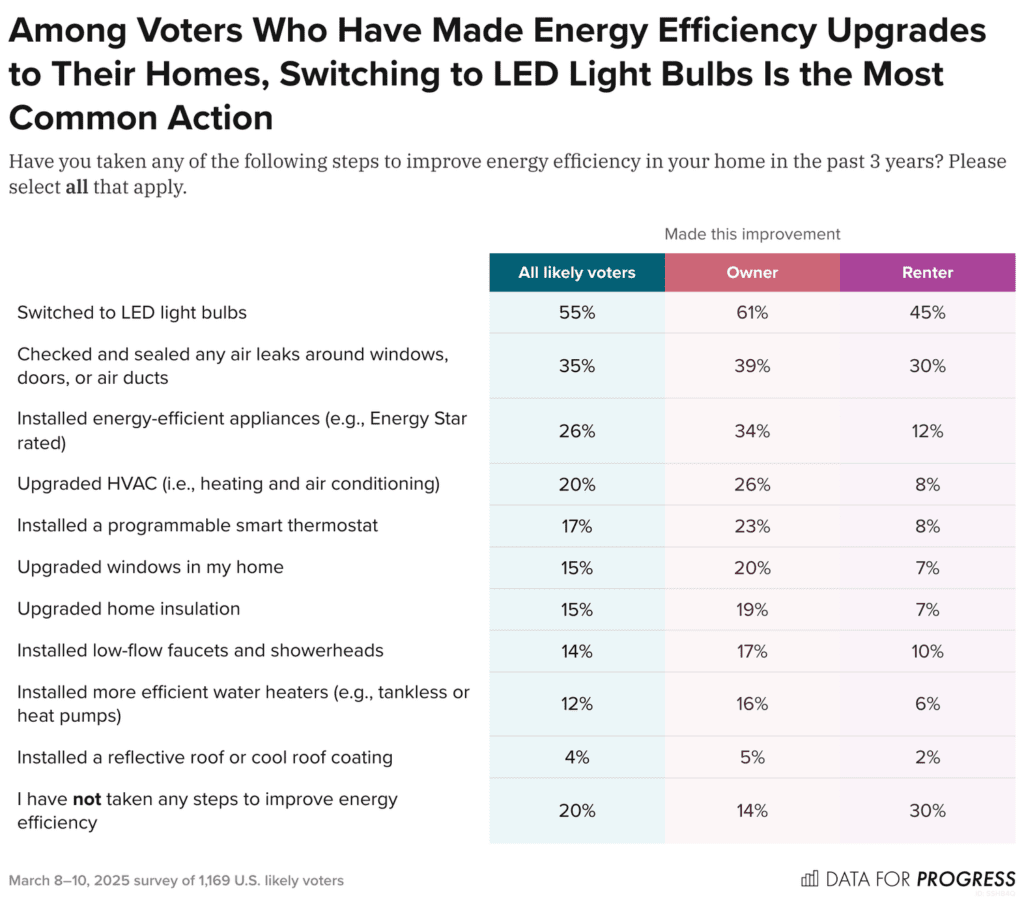

The Data for Progress survey of 1,169 likely voters aimed to understand how people think about energy efficiency and its impact on homes. Not surprisingly, more homeowners (72 percent) than renters (61 percent) are familiar with energy efficiency. Also, among voters who made energy efficiency upgrades in their homes in the past three years, the most common efficiency action they’d taken was switching to LED light bulbs (55 percent). Just 15 percent reported upgrading home insulation, which by far is the best way to improve energy efficiency in a home. Just 15 percent of voters say they took advantage of tax credits or rebates, while 63 percent of respondents said they were unaware of any tax credits for rebates available to them. More curious is that another 15 percent of respondents who’ve undertaken energy efficiency improvements report being aware of available tax credits or rebates and still not taking advantage of them, leaving money on the table.

Upfront costs are a hurdle

Voters say the high upfront costs of home energy efficiency improvements are the most significant barrier, with nearly half of all voters (46 percent) saying costs are an issue. Fifty-eight percent of homeowners cite the expense as the major hurdle.

These perceptions highlight the lack of awareness of federal and local incentives to lower the costs of home energy efficiency upgrades.

The good news? An overwhelming majority (71 percent), believe incentivizing energy efficiency adoption through federal tax credits is a good idea.

Bottom Line

Support for energy efficiency is among the few things in America with broad bipartisan support. The Inflation Reduction Act provides a tax credit to cover 30 percent of the cost of energy efficiency improvements (including up to $1,200 for air sealing and insulation). But a persistent challenge is ensuring that Americans know about all the tax credits, rebates, and incentives available to increase their home’s energy efficiency, which they say they want (likely because the majority of voters – 57 percent – believe energy efficiency improvements would increase the value of their property.)

All of this demonstrates the need for continued support of energy efficiency and messaging about the availability of tax credits to help homeowners lower their energy costs.

We’ll keep doing our part, promoting adding air sealing and insulation to the attic as the first energy efficiency improvement action.

To review the complete Data for Progress survey research findings, click here.