The American Council for an Energy-Efficiency Economy (ACEEE) recently released a new fact sheet on the use of the 45L Builder New Home Tax Credit. The credit aided home builders nationwide last year – spurring the construction of 350,000 new energy-efficient homes, which resulted in significant cost savings for home buyers. That amounts to roughly 22 percent of new homes built in 2024.

Diving into the Data

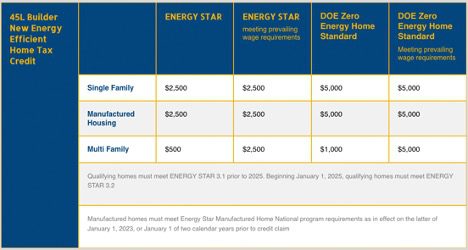

Builders can use the 45L tax credit for single-family, multifamily, or manufactured homes built to EPA ENERGY STAR (v 3.2) or U.S. Department of Energy (DOE) Zero Energy Ready Home Standards. The value of the credit increases for the builder if they meet the prevailing wage requirements under either program. (See chart below).

ACEEE’s analysis estimates that between now and 2032, when the credit expires, it can help spur the construction of more than 3 million qualifying homes, saving homebuyers an average of $400 annually in energy costs for ENERGY STAR homes and more than $1,000 for ZERH homes. The estimated lifetime energy cost savings (45 years) would equal about $17,500 for an ENERGY STAR home and $50,000 for a ZERH home (in 2024 dollars).

The average lifetime savings benefit is $11,000, calculated using a 3 percent per year real discount rate for future benefits. In addition, based on the number of certifications last year, the average tax credit is $2,700 per home, according to ACEEE analysis. Given this, the discounted energy savings benefit is more than four times the cost of the average tax credit amount. Thus, the cost to the Treasury is low for the tax incentive — $1.7 billion from 2025 until the credit expires in 2032, according to the most recent score.[1]

Benefits of 45L

Homes constructed leveraging the 45L tax credit offer benefits beyond those of the builders and homeowners. The added boost in efficiency helps reduce peak electrical demand, lowering the strain on the electric grid. ACEEE estimates that by 2032, peak demand savings of 1,800 MW can be realized. This is equivalent to the power output of three large power plants.[2]

Builders have incorporated the 45L tax credit into their home designs, construction plans, and supply chains; some have plans to leverage it over multiple years. Further, the credit has widespread support from stakeholders, including the Leading Builders of America (which represents 700 percent of new American homes), the Manufactured Housing Institute, the American Chemistry Council, the American Institute of Architects, the U.S. Green Building Council, and NAIMA.

The Takeaway

The tax credit could be threatened as Congress considers ways to pay for extending President Trump’s tax cuts. “Ending the credit now would disrupt the supply of new homes. Without the credit, builders would have to decide whether to increase the prices for their homes, change their designs and suppliers – which could delay construction, or even not build new homes,” ACEEE concluded. Thus, ensuring the tax credit remains in place is good for the future of home building.

[1] https://www.jct.gov/publications/2023/jcx-7-23/

[2] This estimate assumes increasing usage of the tax credit through 2032 and the overall radio of peak to annual savings in 2023 based on reporting on the U.S. Energy Information Administration Form 861.